Table of contents:

- Author Bailey Albertson albertson@usefultipsdiy.com.

- Public 2023-12-17 12:53.

- Last modified 2025-01-23 12:41.

How can those who do not pay taxes by December 2 be punished?

If you own property, pay taxes. This rule is best observed. With personal ownership of land, housing or transport, you must pay the state property taxes annually. You need to pay for them in 2019 until December 2. There is nothing left in time, and you need to have time to do everything in time. Indeed, for failure to comply with tax obligations within the established time frame, the owner may be overtaken by retribution: from the collection of a penalty to imprisonment.

What taxes need to be paid

All issues related to tax obligations are regulated by the Tax Code of the Russian Federation. He also establishes their gradation, terms of entering into the state treasury and sizes. By the beginning of winter, Russians must pay off taxes on property at their disposal, vehicles and land plots.

- Transport tax. It must be paid by those on whom, according to documents, cars, snowmobiles, motorcycles, yachts and other types of transport are registered.

- Property tax. Mandatory tax deductions on it must be made by the owners of apartments and rooms, houses and summer cottages, and even garages and parking spaces. In addition, this tax applies to capital construction projects. It is important to know that if a person is only registered in the premises and is not its owner, he is not a taxpayer.

- Land tax. It is charged by the IFTS to the owners of land plots. If there is a dacha in the possession, standing on an allotment of land, then two notifications will come from the inspection - on the land and on the real estate located on it.

There is a small nuance - you need to pay only for the property that is available in a certain tax period. If in the previous 12 months there were none of the above objects, then you can sleep peacefully.

How can a debtor be punished

For unpaid payments on mandatory fees, punishment will inevitably come. It depends on the total accumulated debt and the continuity of the billing period. The responsibility that the violator incurs can be administrative, tax and even criminal. The latter can be attracted even for unpaid tax on the sale of an apartment.

As for the punishments themselves, then, firstly, these are penalties that are charged for each day of delay. In addition to them, penalties are provided for violation of the terms of payment. And if the taxpayer does not take any action to resolve the issue of debt settlement, the tax inspectorate has the right to file a claim. And court decisions, in turn, can threaten both forced labor and arrest, up to imprisonment.

Calculation of penalties

If you do not settle with the state in a timely manner, then in addition to the amount due under the tax obligation, you will have to pay out of your pocket also a penalty. They are accrued for each delayed day from the date of mandatory tax payment. In total, this value cannot be higher than the amount of the tax levy. For individuals, the interest rate on fees is one three hundredth of the refinancing rate of the Central Bank of the Russian Federation effective at the time of its calculation. In 2019, this figure was 6.5% per annum.

To calculate how much to pay in excess of the established rate of deductions for property tax, you can apply a simple formula: Amount of penalties = tax amount x number of calendar days of delay x 1/300 of the Central Bank's refinancing rate.

On the day the overdue payment is paid off, the accrual of interest ends.

Payment of a fine in the prescribed amount

Fines for violation of payment deadlines are 20% of the amount of outstanding tax, but not less than 1,000 rubles. Moreover, its maximum value cannot exceed 30%. Since 2019, the tax services have added the right to fine for the fact that he did not report to the IFTS about the property acquired. The size of the penalty in such a situation is considerable - 20% of the unpaid tax amount. A slightly smaller penalty from 500 rubles to 1,000 is provided for refusing to provide the required documents to the tax officer.

Tax liability entails only the imposition of fines assigned and calculated by the Federal Tax Service Inspectorate based on the type of misconduct committed (Article 122 of the Tax Code). Their size can reduce the presence of appropriate bases. Difficult life situations are recognized as such circumstances - illness, death of loved ones, etc. At the same time, for repeated violations of the terms of payment - the penalties are doubled.

Six months after the penalty interest has started counting, and if the amount of the debt has exceeded 3,000 rubles, the tax office can file a claim with the judicial authorities. Then the criminal act will fall under the jurisdiction of administrative or criminal liability. The amount of fines will increase accordingly. If they are found guilty in accordance with the Criminal Code of the Russian Federation, then they will have to pay from 100 thousand rubles to half a million.

Passage of forced labor

Those who deliberately evade taxes face criminal punishment. Now we are not talking about an organization, but about a private person. Art. 198 of the Criminal Code of the Russian Federation provides for several options for punishment, including forced labor for up to 1 year. But for this measure of restraint, you need to be a malicious defaulter and accumulate debts of no less than 900,000 rubles. At the same time, the nuance is taken into account that the debt is not repaid without interruption for three years.

Arrest or imprisonment

The larger the amount of debt, and the longer tax notices are ignored, the more chances the owner has to become accused under Art. 198 of the Criminal Code of the Russian Federation. The court has the right to choose a punishment under this article, and instead of a huge fine, impose a punishment in the form of arrest up to six months. If the amount of tax debt is measured on a large scale, then a court verdict for 1 year in a penal colony is also possible. And in cases where the tax debt exceeds 4.5 million rubles, they can be imprisoned for 3 years.

Recommended:

Interesting Facts About Cats And Cats: What Taste They Don't Feel, Do They Sweat, Do They Understand Human Speech And Answers To Other Questions

How cats differ from humans. How cats feel, hear, see, remember. Their relationship to the game. What does purr and tail wagging mean. Reviews

Whiskers In Cats And Cats: What Are They Called Correctly And Why They Are Needed, What Will Happen If You Cut Them And Why They Fall Out Or Become Brittle

Features of the structure of the mustache in cats. What are they called and where they are located. What functions do they perform. What problems can a cat with a mustache have? Reviews

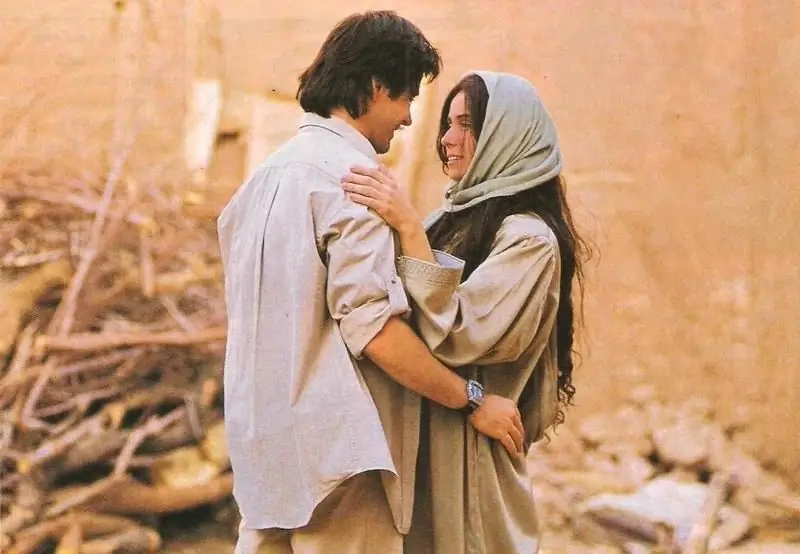

Actors From The TV Series "Clone" Then And Now: Photos, How They Have Changed, What They Do

Actors from the TV series "Clone" then and now. How your favorite characters have changed and what they do

Actors From The TV Series "Tropikanka" Then And Now: Photos, How They Have Changed, What They Do

Actors from the TV series "Tropicanka" then and now. How they have changed and what they are doing today

Why Castrated Cats Can't Fish, What They Can Eat

Why neutered cats shouldn't be given fish, what else shouldn't they eat. The diet of a castrated cat