Table of contents:

- Author Bailey Albertson albertson@usefultipsdiy.com.

- Public 2023-12-17 12:53.

- Last modified 2025-01-23 12:41.

What is cashback and how to use it

The word "cashback" literally translates from English as "cash back". However, the essence of this system is not entirely and not only in this.

What is cashback

Cashback is a return of part of the money for previous purchases made in a store or with a bank card. The system became widespread in Great Britain and the USA, from where it migrated to Russia and other countries.

Why cashback is beneficial for banks and sellers

Of course, a free refund of a portion of a purchase may seem suspicious. Fortunately, cashback is not just another economic deception, but a system of increasing customer loyalty that is quite beneficial for entrepreneurs.

In fact, cashback is a marketing ploy, a kind of advertising for a company. And since this technique allows sellers and banks to significantly increase the number of their customers and customers, the cost of returning them money completely pays for themselves.

Marketing development, although it spends the lion's share of the budget, but with a competent approach returns the company much more

Cashback types

Despite the fact that the term is used in many areas, cashback in a bank and in a store is a completely different system.

In trade

In trade (including on Internet sites), this term denotes a deferred fixed discount on future purchases. Usually it is credited in the form of points or rubles to the buyer's card.

An example is the re: Store. Part of the money spent on any product is returned in two weeks to the “honorary customer card”. In the future, this money can be used to pay a certain percentage of the purchase amount.

To use cashback in a selected store, you need to get a loyal customer card (the name may vary in different stores). Many merchants are now switching to e-cards that are stored directly in Wallet (iOS) or Wallet (Android).

Storing cards in a smartphone is much more convenient than plastic counterparts

In the bank

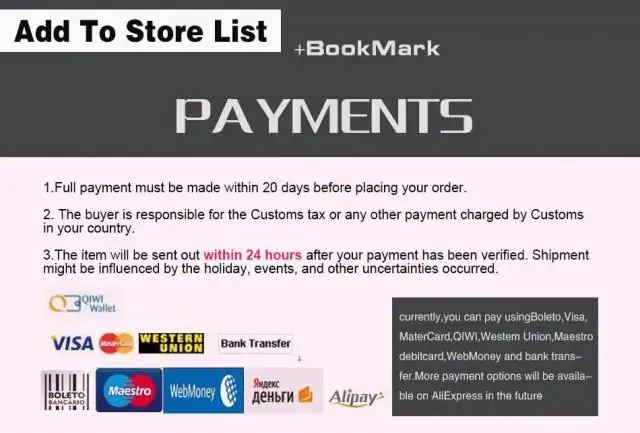

In the banking sector, the cashback system works a little differently. The consumer issues a bank card with a money-back function. A certain percentage of the amount spent is returned to his account (usually from 0.5 to 3%). But not everything is so simple - there are a number of restrictions:

- most banks provide cashback to the client only when buying from a certain partner organization. Moreover, the percentage of money returned may depend on the type of services or goods that the consumer spent on;

- using a cashback card is appropriate if you spend a lot of money on non-cash payments. Most banks set a limit on the minimum amount of purchases per month under which a refund option is provided;

- it is also worth considering the cost of servicing cashback cards. Usually it is higher than that of regular debit cards, so it is important to calculate how profitable the use of such a service will be.

Today, many large banks in Russia offer their customers cashback cards:

- Russian Standard (Platinum card);

- Rosbank (Supercard card);

- Alfa-Bank (Cashback card);

- Tinkoff (Black card);

- Ural Bank (Maximum card);

- Raiffeisenbank (#VseSrau credit card).

In cashback services

Cashback services are Internet portals from which the buyer can go to the website of the partner store. The latter sees that the service has brought a buyer, and pays this portal a percentage of the sale. The cashback service, in turn, shares some of this money with the customer.

To use the cashback service, you need to register a personal account in it. After registration, go to the websites of online stores only from the cashback portal, otherwise the system will not count you as a participant in the refund promotion. The use of services is intuitive:

-

Find the store you want in the list. Portals usually have a search by partners and categories.

An example of finding the right store The button "Go" is located under the store logo.

- Go to the store website.

- Buy and pay for the product you want.

-

A record will appear in the personal account of the cashback portal that funds are expected to be credited from the store visited.

Personal account view in the cashback service In the personal account, the user sees not only the already accrued rubles, but also the money that is expected soon

- When the required amount has been accumulated, withdraw it using any of the proposed methods.

Important criteria for choosing a cashback service are the number of supported stores, the percentage of return, the minimum withdrawal amount, the methods and conditions for withdrawal. Among the most versatile and covering a large number of stores, the following services can be distinguished:

- LetyShops;

- ePN Cashback;

- Cash4Brands;

- Kopikot;

- "Discount.ru";

- cashback.ru.

Cashback is a convenient savings system for buyers. If you use it competently and skillfully, you can reduce the costs of many goods and services several times.

Recommended:

Which Epilator Is Better For Home Use - Laser And Other Types, For The Face And Bikini Area, Options For Sensitive Skin, Basic Parameters And User Reviews

Appointment and types of epilators. Description of the action of the devices. How to choose the best among them. What are the rules for caring for him. Reviews of the best brands

Interior Laminated Doors And Their Varieties With A Description And Characteristics, Advantages And Disadvantages, As Well As Use And Compatibility In The Interior

What are laminated doors: varieties and their characteristics. How to choose and install doors. Tips for the operation and repair of laminated doors

Antigadin For Cats: Instructions And Indications For Use, How To Use The Spray Correctly, Reviews, Cost And Analogues

Forms of release of funds Antigadin. What is it for and how to apply it. Advantages and disadvantages, comparison with analogues. Folk remedies "antigadins". Reviews

Roofing Profiled Sheet, Including Its Types With Description, Characteristics And Reviews, As Well As Processing And Use Features

Using a profiled sheet to cover the roof. Classification, features of work and operation of corrugated board. How to cut a profiled sheet into fragments of the desired size

What Facts Exist About Borscht, Which Many Consider To Be A Common Dish

What interesting facts show that borscht is not such a simple dish